Answer to the Problem and Explanation

ANSWER TO THE PROBLEM AND EXPLANATION

IT MUST BECOME ECONOMICALLY WORTHWHILE TO MAKE A HOUSE ENERGY EFFICIENT.

This is calculated here using borrowed money (at mortgage interest rates) to carry out the work or buy equipment such that any borrowed cost is paid for in an easy way when the property is bought and sold.

Major Actions

- Government, often acting through Local Authority must demand that all houses changing hands must be insulated within 4 years of acquiring the house. This can be through regulations, direct laws or taxes

- Professional Valuers must realise that this will decrease the value of a property (that a mortgage company could recoup if payers is in default) and hence dropping the property price for the buyer by the amount needed to insulate. They must realise that a lower drop in ‘value’ is seen if less energy efficiency work is needed to be done.

- Mortgage companies may see people who are still paying off their mortgage be doing so on a house that has fallen in value due to poor insulation. It is likely that this will be a risk to few and political action may appear, but some house owners must be warned of the change.

- If a house is being sold again after only being in it for less than 5 years then a grant would be needed to cover the loss. This grant decreases the longer you have had the house to zero after 5 yrs of occupancy. So if the Government introduced the regulations in 2025 then this grant would stop altogether in 2030.

- A second grant is needed if you have a low EPC house (e.g. D or worse) and selling, then this grant covers the amount saved to bring the next house up to an EPC (generally less than £12,000). Of course you will, after the next house is brought up to EPC B then you will be healthier, and living in a warm house. Explanation of grants: see Biggest Costs

Why will this work?

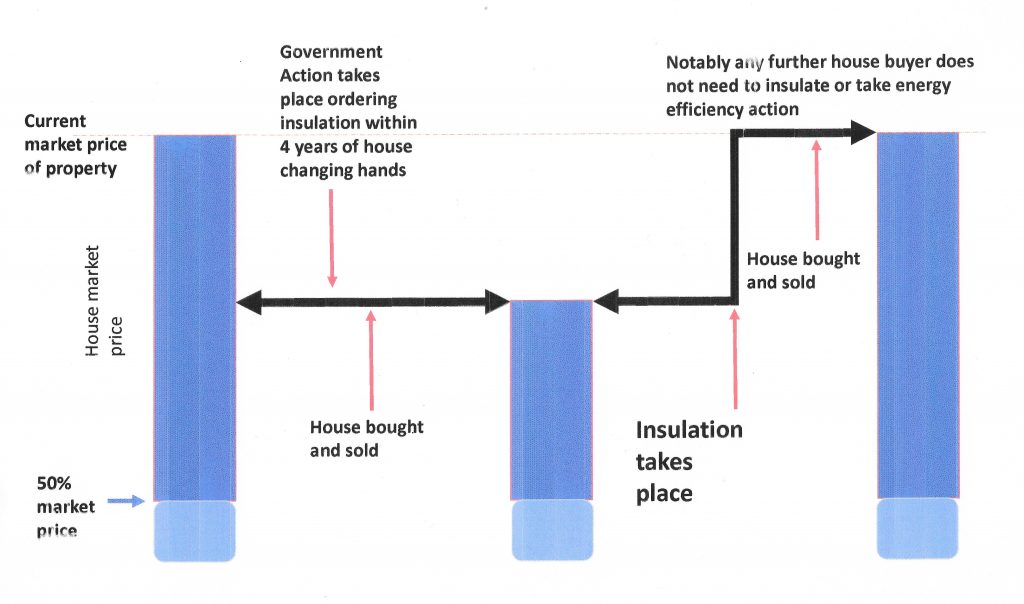

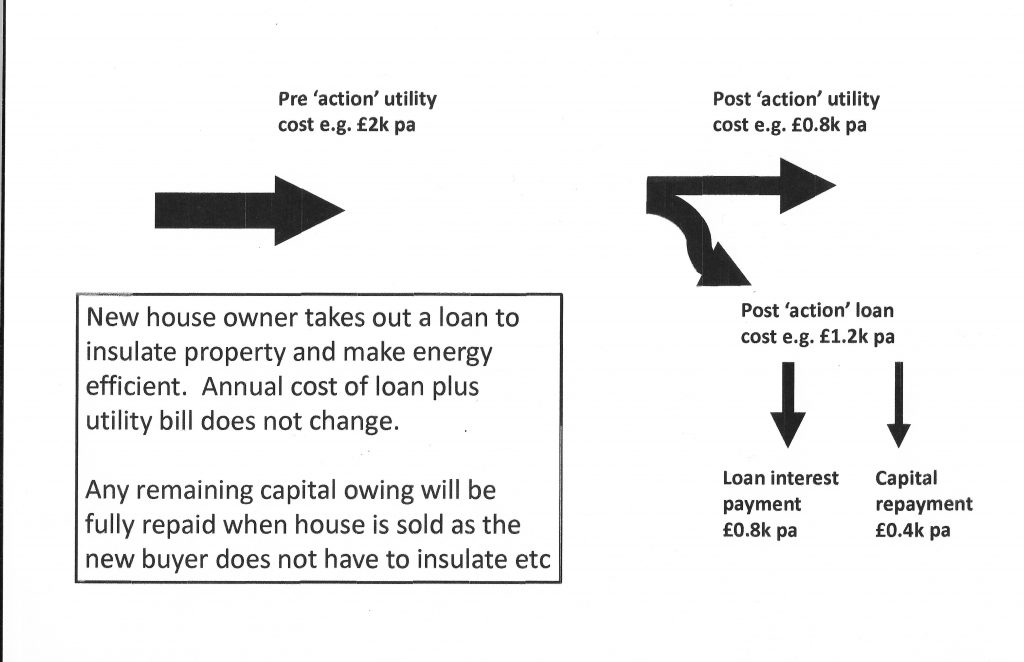

Upper figure (number 1 below) shows why someone buying an uninsulated house can insulate it with no risk of loss. The ‘current value’ of a house is ‘as much as could be possible’ by a buyer, but the Government action (seen above) means that the buyer cannot pay the ‘current price’ but must spend some of their mortgage loan on the work required. Any interest on the loan for insulation is paid in an ongoing way by 60% drop in utility bills. Some capital payment on the loan is also paid off similarly, but debt left over on this long term loan will gradually get smaller while the property is owned. When the property is resold all of the remaining loan is repaid (the property value rise will cover this) and the amount of this that has already been paid can be used to buy a ‘better’ property. The lower figure (number 2 below) shows how a house seller of a poorly insulated house can buy another, similar, one at the same price, must then insulate it and that process will cause the value to leap up to the original value before the Government action took place. This is because no further buyer would need to carry out any of the work on the property towards insulation or energy efficiency. What is happening is that yes there is a cost in carrying out the work but it always gets paid by lower utility bills and inflation and Government Grant.

Figure 1. The market value of a house currently is greater than it then drops to after Government action. After insulation by the buyer this price increases back to what it had been originally.

Figure 2. When insulating the house a buyer may need to borrow money from the mortgage company. This shows how the lower utility costs will pay both the interest and the capital on that loan.

Result

Mortgage companies usually already demand that some technical house problems (rot, roof leaking etc) must be fixed before the full mortgage provided. We propose that similarly they may find that properties must be fully insulated within 4 years. Mortgage companies can demand and can calculate, with the help of Valuers, the amount that this would increase the value of the property (because any further buyer would not have to insulate). So they could offer a mortgage rate loan to allow the buyer to insulate because this action would cause no added risk to the Mortgage company as the value of the property would increase. Numbers of houses doing this would rise to a peak in 10 years. Of 15.4m owner-occupier houses 307,000 are bought and sold annually in the UK, but only about 100,000 probably will need full insulation (0.65% of housing in the community). That will mean that in a major town like Preston (65,800 homes) 428 per year will need this work. It takes 2-3 weeks by trained staff on a terrace or semi-detached property. If devices like PV and ASHP are needed this may be done later. A single small company will carry this out on around 20 properties per year so Preston would need 21 small companies working all year.

After the Government action (above) buyers will want to get all the insulation work done as soon as possible. However, there is a shortage or few SMEs to carry out the work. This will change quickly as currently many people being trained on building practices often just don’t carry out the courses on retrofitting for insulation because they think there is no money in it. That would change rapidly.

Estimated period for all the work on older properties, probably built before 2000, are calculated to be carried out by 2045-50

House prices will be expected to return to current levels after insulation is done. That is a major item when working out costs. Also proposed is that new residential properties where currently the builder tries his best to include as little energy efficiency as possible to keep costs down may realise that all the bidders for the building land will have to fully include this. That would cause building land prices would drop.

An Infrared photo of a terrace currently. Red is warm and blue is cool. This shows that currently it is common to insulate roof spaces but walls remain a problem.

Academic References

Ibn-Mohammed T, Greenough R, et al. Integrating economic considerations with operational and embodied emissions into a decision support system for the optimal ranking of building retrofit options. Build Environ. 2014;72:82-101

Haines V, Mitchell V. A persona-based approach to domestic energy retrofit. Build Res Inf. April 2014:1-15.

Gooding L, Gul MS. Energy efficiency retrofitting services supply chains: A review of evolving demands from housing policy. Energy Strateg Rev. 2016;11-12:29-40

Gooding L, Gul MS. Achieving growth within the UK’s Domestic Energy Efficiency Retrofitting Services sector, practitioner experiences and strategies moving forward. Energy Policy. 2017;105:173-182

Booth AT, Choudhary R. Decision making under uncertainty in the retrofit analysis of the UK housing stock: Implications for the Green Deal. Energy Build. 2013;64:292-308

HM Government. Climate Change Act 2008 (c.27), s 1(1). United Kingdom.

HM Government . In: The Carbon Plan: Delivering Our Low Carbon Future. Department of Energy and Climate Change (DECC), editor. London: HM Government; 2011.

Academic and Technical Assessment

Technical requirements for full insulation vs Assessment of a property and indication as to how an Assessor could indicate what work could be expected to be carried out.

Assessment of business models for the house buyer, insulating company, bank, and for the Treasury’s view of Society.

Assessment of the improvement of CO2 emission in the UK.

Assessment as to whether a similar system would be valid in other parts of Europe.

Assessment of whether it would be best to put forward this proposal as being as a local technical requirement (and so overseen locally), defined nationally (as from the Net Zero Department to allow changes to take place), or through national taxation changes claims.