EARLY, WHEN RUNNING THIS PROTOCOL FOR WIDESPREAD HOME INSULATION, MANY HOUSE OWNERS MAY NOT BE ABLE TO AFFORD THE COSTS. THAT PROBLEM WILL GRADUALLY GO WITH LOW COST LOANS AND GRANTS

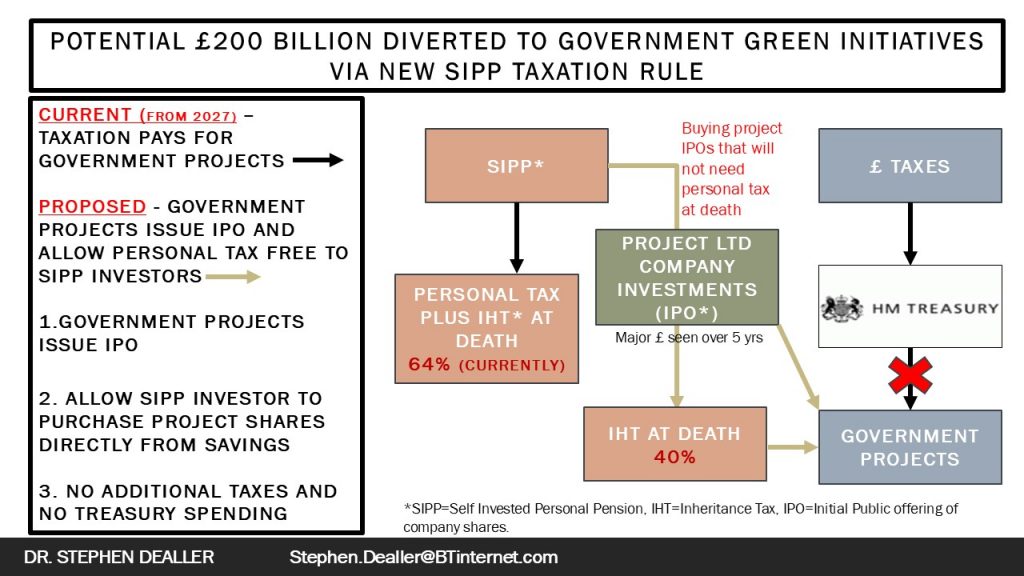

Explanation of how ‘Potential £200 billion diverted to Government Green Initiatives via SIPP taxation rules’ works

Allowing SIPP investors to convert investments to be those in Government defined Inheritance Tax-free bonds or similar shares. When the person dies there might be no IHT on the value of these assets or perhaps without personal tax paid after death.

Full Explanation of How This Works: This was published at the All Energy Conference in 2025 Self-invested Personal Pensions (SIPPs) were set up by Gordon Brown in 2009. The idea was for people in the UK to invest without having to pay personal tax on income, no tax on capital gains but personal tax payable on taking money out and IHT payable on death assets. Currently there is £500 billion in SIPPs and owned by 700,000 people but 10% of them own half the money i.e. £250 billion. Effectively the Government has lost large amounts in tax but some investors have made enormous gains. Around half is invested in the UK and the regulations do not permit further investment outside the SIPP.

- People do not know when they are to die and the richest SIPP owners realise that they can take their money out of the SIPP, paying 40% tax as Personal Income tax they will also hit a 40 % Inheritance tax (IHT) bill at death or a similar 40% tax personal tax before then. So heirs may get 36% of asset left in the SIPP (i.e. taxed twice).

- As a result, the richest SIPP owners are probably receiving money from pensions and sitting on large SIPP invested money. They are aching for a system that they can somehow avoid either Personal Income tax or IHT but keeping the money still available to them if needed or to their heirs when they die. Half of the money is invested in the UK.

- If you follow the black arrows, it is what is happening as of 2027 budget. The IHT would appear in the Treasury from this over the next 25 years. This has been declared as being £1.5 billion per annum. My own calculations put it as slightly higher at £2 billion but falling as the 25 yrs progress due to SIPP owners take out their money under the upper end of personal tax rate (currently removing around £50,000 pa)

- Follow the brown arrows: The Government permits SIPP owners to invest in Government projects (generally capital ones). This can be done through an investment company that can advise and buy the shares or lend on behalf of the SIPP owner. This investment is done through Public Offerings of shares by the projects using MIFID rules. As a result, these shares are made IHT-free and can be given directly to heirs or not requiring personal tax when their value is taken out of the SIPP. The heirs can sell the shares again or keep them and their value will depend on the success or failure economically of the projects. They cannot be re-used as IHT-free.

- This would give rise to large amounts of SIPP assets being taken out by the owner and invested in limited numbers of shares in project the Government project companies such that it will be clear that investment should take place early (over around 5-10 yrs perhaps). If it turns out they need the money back the SIPP owner can simply sell the shares on to current SIPPs.

- The Treasury will save money that is no longer being spent for its projects (Big red cross on diagram)

- Assuming the wealthy SIPP owner invests amounts representing 100% figures in the Government projects whereas, if being taxed at IHT or higher rate personal tax, the Exchequer would only gain 40%. As of 2027 budget the Treasury is expected to gain 60% of a SIPP value. (in proportion to amount invested) over around 25 years. With the proposal shown the Treasury will lose £60 billion overall.

- If the Treasury does go with the proposal shown in the diagram SIPP owners will find the IPO share buying easy, clearly worthwhile, being investments carried out over 1-10 years and the heirs would gain that £60 billion.

- It should be noted that the projects would require no Treasury funding whatever in many projects that need it quickly. E.g. starting up Great British Energy, House Insulation UK, Forestry, Long Term Patient Capital, Housing.

- Investment in new projects from by pensioner SIPPs comes from the sale of around £100bi of UK shares on the open market a further £100bi is currently invested abroad. Hence the system would require the SIPP owner to sell shares on the market, but half of the value would come from foreign markets.

A similar system is being used in the USA by the IRS to great advantage to the Government. It makes American donation to charity very much worthwhile.

Many SIPP investors currently see growth but worry about the double taxation that would take place on their death. They also worry about how another economic bust may crash the overall value with their investments in banks, risky stocks, shares in unessential products or services, high tech, bitcoin, or income from companies with a high workforce. Some of these can be bypassed by investing in gold, bonds etc. The use of their SIPP for investment in essential Government projects in will be encouraging in a boom and bust from American AI for instance as this will crash will be worldwide.

RESULT of this a very large amount of money, half of which was invested abroad, would become invested in UK capital from which there will be an income return. Many of the green projects would not be certain to create huge incomes to the investor but the large amount that the SIPP owner no longer pays to the Treasury will easily make them a worthwhile. This takes place rapidly and projects may not need the huge sums. E.g. as Great British Energy progresses with capital projects or house insulation.

Reference: Academic

Dealler SF. £200bi diverted to Green Government Initiatives using new SIPP taxation rules. (poster and presentation). All Energy Conference Glasgow 2025.